Image credits: Pexels

In today’s fast-paced world, the once-simple task of personal budgeting has become far more difficult. Amid inflation pressures, increasing debt, and a need for financial independence, Americans are looking for smart tools that can handle their expenses. With the right combination of automation and a human touch, it is possible to create an adequate budget for the future.

Budgeting Designed to Change Behaviors

Modern budgeting apps aren’t just meant for tracking expenses, offering insight into financial behaviors, and providing personalized coaching. It’s hard to imagine budgeting as a quick fix to any problem today, which is something this fintech movement recognizes. Instead, modern budgeting apps help users treat budgeting like a lifestyle change, changing habits and creating advantages.

Modern budgeting tools are proving their efficacy by addressing the shortcomings of traditional personal budgeting methods, which can be less motivational and inaccurate despite being time-consuming. Rather than a fixed and rigid budget, users are empowered with financial insights that justify every dollar spent and paint a picture of the path toward financial freedom.

Human-Guided Budgeting in Fintech

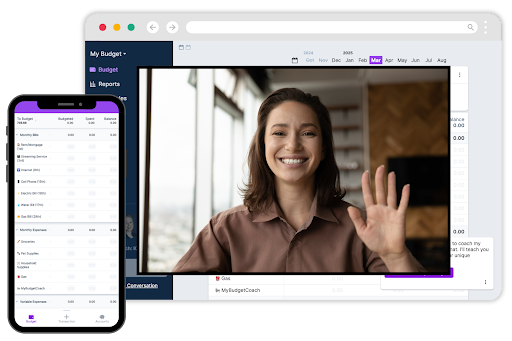

Credit: MyBudgetCoach

Specific platforms aim to create positive change by pairing users with coaches to guide their spending habits. For instance, MyBudgetCoach emphasizes zero-based budgeting (ZBB), a method where all expenses must be justified “starting from zero.” By matching users with financial coaches suited to various niches, these platforms offer guidance that can lead to behavioral change.

“Our whole thing is we want to help people fall in love with budgeting,” MyBudgetCoach founder Zach Whelchel shared. “It’s actually fun when you get into it and you see systems running.”

With support from a financial professional, budget coaching platforms empower users with financial insights designed to give every dollar a purpose. This way, those struggling with their budget can find a path they might have overlooked or feel confident they are moving forward with a reliable guide.

For Whelchel, the difference between expense tracking apps and guided coaching comes down to agency. “Giving your dollars a job before you spend them is like looking forward,” he said, contrasting it with apps that only report spending after the fact.

That forward-looking perspective, combined with a coach’s accountability, helps users change behaviors instead of abandoning the process. He compared it to fitness or health training: “These are skills that take time to learn, and having a coach helps you get there.” With ongoing support, users not only gain financial clarity but also start to see budgeting as aspirational rather than restrictive.

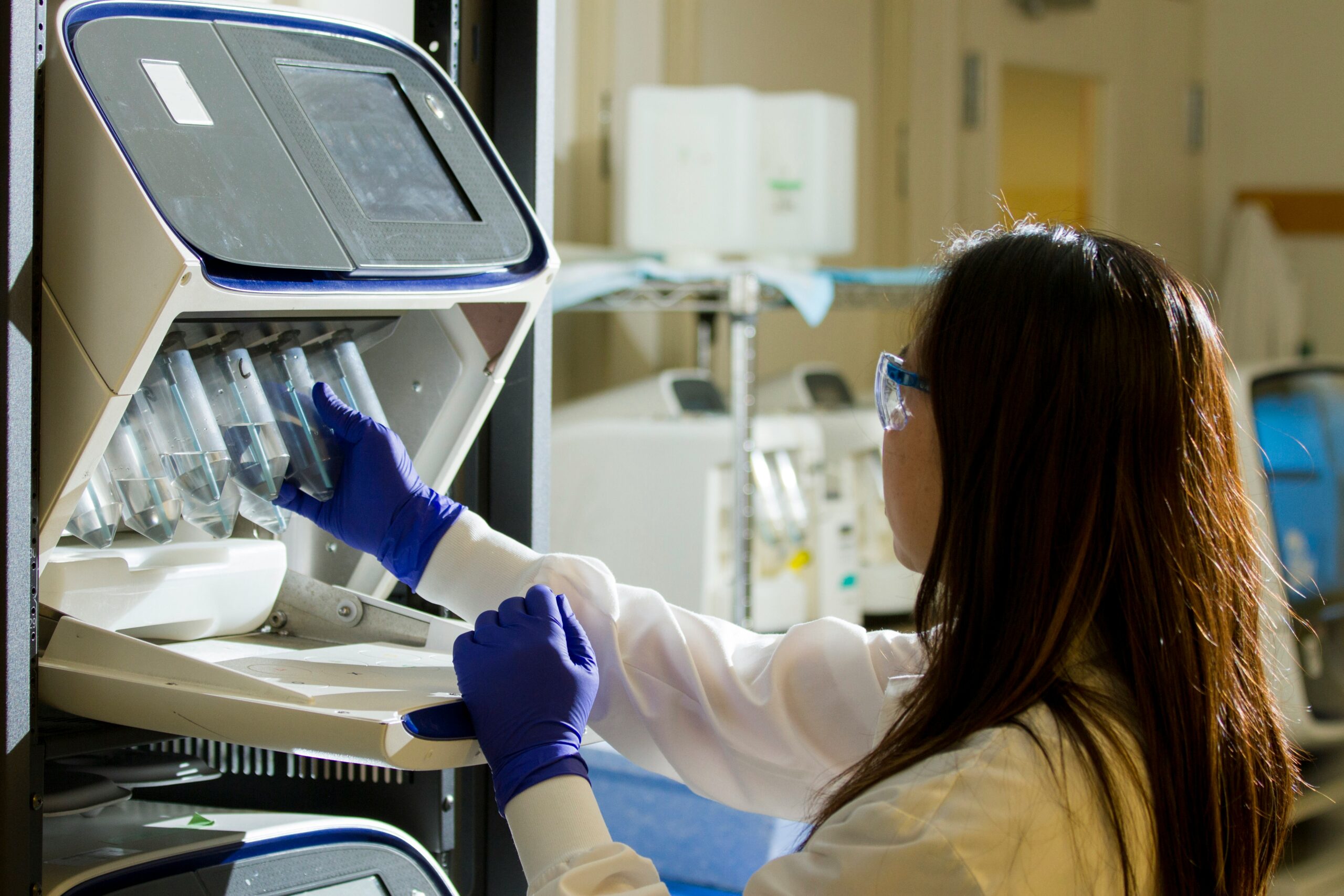

Making Debt Management Feel Achievable

Credit: Legacy Financial

Alternatively, some platforms are designed to help users visualize when they’ll be debt-free and provide the tools they need to realize their goals. Using its patent-pending snowball and blizzard calculators, Legacy Financial App creates these clear visuals for users while offering flexible repayment strategies based on income levels.

“We’re giving hope to the hopeless,” Legacy Financial App founder Michael Smith Jr. explained, “because we’re showing a light at the end of the tunnel. You can afford to send your kids to college… there’s a light at the end of the tunnel.”

Debt management might feel overwhelming, but the knowledge that it is possible to escape financial burden can be empowering. This kind of financial insight helps users to stick to a budget more closely, recognizing that their efforts will be rewarded by financial freedom as they reach the end of the tunnel.

Smith described the power of visuals in making debt repayment feel possible. “When you can literally see the day you’ll be debt-free, it changes everything,” he said, pointing to the app’s snowball and blizzard calculators.

For families, the tool helps translate sacrifice today into long-term confidence. “We’re not just managing numbers,” Smith explained. “We’re giving people a vision of a future where they can pay for their kids’ college or finally buy that home. And that keeps them motivated”. By connecting repayment to personal dreams, Legacy Financial turns budgeting from a burden into a hopeful pathway.

Creating Paths Forward in Personal Budgeting

While traditional personal budgeting methods have felt restrictive, modern tools empower users to move toward financial freedom. With the advantages of automation and real-time data working in conjunction with human guidance that can acknowledge one’s personal struggles, managing money feels less like a chore, but rather a path toward new opportunities.

Relying on the strategies implemented by modern budgeting, there is no need for spreadsheets and guesswork. Financial independence is more easily achieved with professional support and accurate budget accounting. However difficult it may feel to escape the burden of debt or financial responsibility, modern budgeting tools provide the resources necessary to keep moving forward.