Image credit: Unsplash

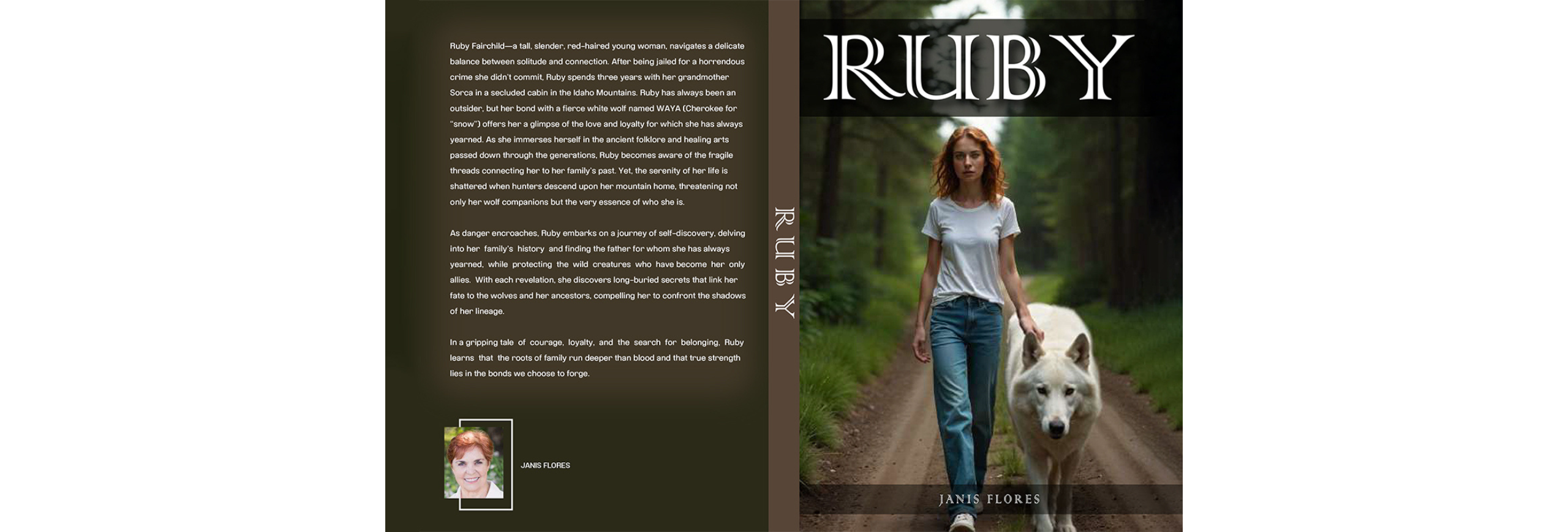

Luxury homes in Los Angeles are up for grabs, with mansion owners getting extremely creative with their sales tactics. Picture this: a majestic manor plus a gratis luxury vehicle to cruise the glitzy boulevards.

As the clock ticks toward the enactment of Measure ULA on April Fools’ Day, purveyors of LA’s swankiest dwellings scramble to entice buyers with irresistible markdowns and closing boons. Dubbed the “mansion tax,” the measure aims to bankroll affordable housing by imposing heftier levies on home sales exceeding $5 million. Property sales exceeding $5 million and homes over $10 million will attract a 4% transfer tax and a 5.5% tax, respectively.

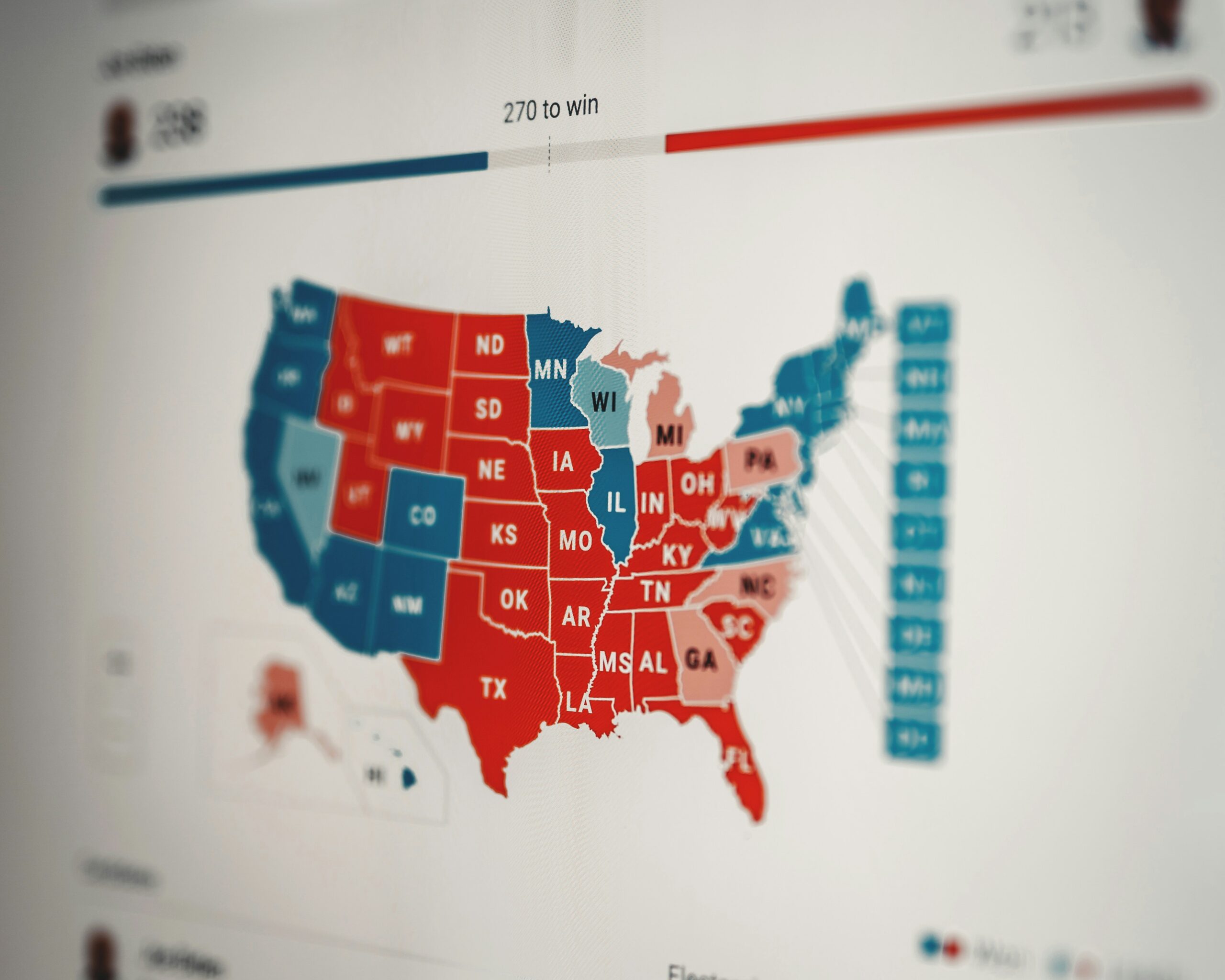

Los Angeles City’s homeless situation has recently worsened, with people building tents in parks, sidewalks, and under freeways. Following a rigorous campaign by housing advocates and labor unions to get Measure ULA on the ballot, it was approved with 57% of the vote in November 2022. The tax’s backers previously projected that it could raise $1.1 billion for affordable housing projects, but last week, the city reduced that forecast to $672 million.

Desperate to beat the taxman’s deadline, real estate impresarios are devising all manner of inventive inducements. In one instance, an exquisite Bentley dangles like a shimmering carrot to beguile potential buyers. Since the seller must pay the tax, individuals with houses on the market use all possible measures to encourage quick closing.

Josh Altman, celebrity realtor and CEO of Altman Brothers Real Estate, explains that these extravagant enticements are, in fact, prudent cost-saving maneuvers once the ULA tax kicks in, offloading these lavish residences will prove even costlier than dispensing decadent perks. “We gave out a one million dollar perk to every realtor who brought a buyer to our properties if we closed the deal by April 1,” he said.

The ULA supporters perceive that the money collected from the levy would fund affordable housing initiatives and lower the city’s homeless population. The money will also help low-income seniors and increase housing affordability.

However, many top brokers and realtors oppose the new regulation and believe there may be more effective ways to fund low-income housing efforts. They claimed the tax is ill-advised and has caused a sudden sell-off among the city’s wealthiest homeowners. According to them, there are many available funding programs and more options to get the money than taxing individuals. “Are the programs operating properly? Are they being managed most effectively?” one of the agents asked.

Another argument against the tax from the opponents is that since it will be applied to all real estate transfers, including those of commercial and multifamily properties, it might have the unpremeditated consequence of encouraging developers to build homes outside the city limits. “The housing market is in trouble. And we’re discouraging housing developers from building. Therefore, it makes no sense to me at all,” added Mr. McKillen, a luxury agency broker.

LA’s quest for supplementary tax revenue to combat homelessness is not new. In 2016, the city greenlit a $1.2 billion bond proposal, “Proposition HHH,” earmarked for constructing thousands of affordable housing units. Regrettably, progress has been sluggish. Merely a third of the projected 12,000 units have materialized, while construction costs have skyrocketed. A 2022 audit revealed some units’ expenses surpassing a staggering $800,000.

Since Proposition HHH’s approval, LA’s homeless population has swelled by a disheartening 45%. As the mansion tax looms, it remains to be seen whether this novel strategy will succeed in its mission to alleviate homelessness or become another well-intentioned but ultimately faltering effort in the City of Angels.