Los Angeles has long been recognized as the heart of the film and TV industry. However, recent data from FilmLA reveals that the industry is still grappling with the aftermath of last year’s strikes, despite a noticeable uptick in production activities. In the first quarter of 2024, total location shoot days rose to 6,823, marking a 23% increase from the fourth quarter of 2023. Nonetheless, these figures remain 20% below the five-year average for the same period and have not yet returned to the levels observed prior to the strike.

The decline in production began even before the Writers Guild of America and SAG-AFTRA initiated strikes last summer, which significantly halted most scripted production across the nation. The end of the strikes, about five months ago, did not instantly revive production rates. “There was a really delayed return to production,” stated Philip Sokoloski, a spokesman for FilmLA. “We knew it could take six to eight weeks for TV, and for feature films, it might be a little longer.”

FilmLA, responsible for issuing permits for location shoots in the Los Angeles area, provides data that, while not encompassing soundstage productions, serves as a reliable indicator of overall production trends. The agency’s recent reports cover a wide range of production types, including commercials, reality TV, scripted shows, feature films, documentaries, and music videos. Notably, while film and scripted TV are on a rebound, reality TV, which wasn’t directly affected by the strike, has seen a decline in the first quarter of 2024.

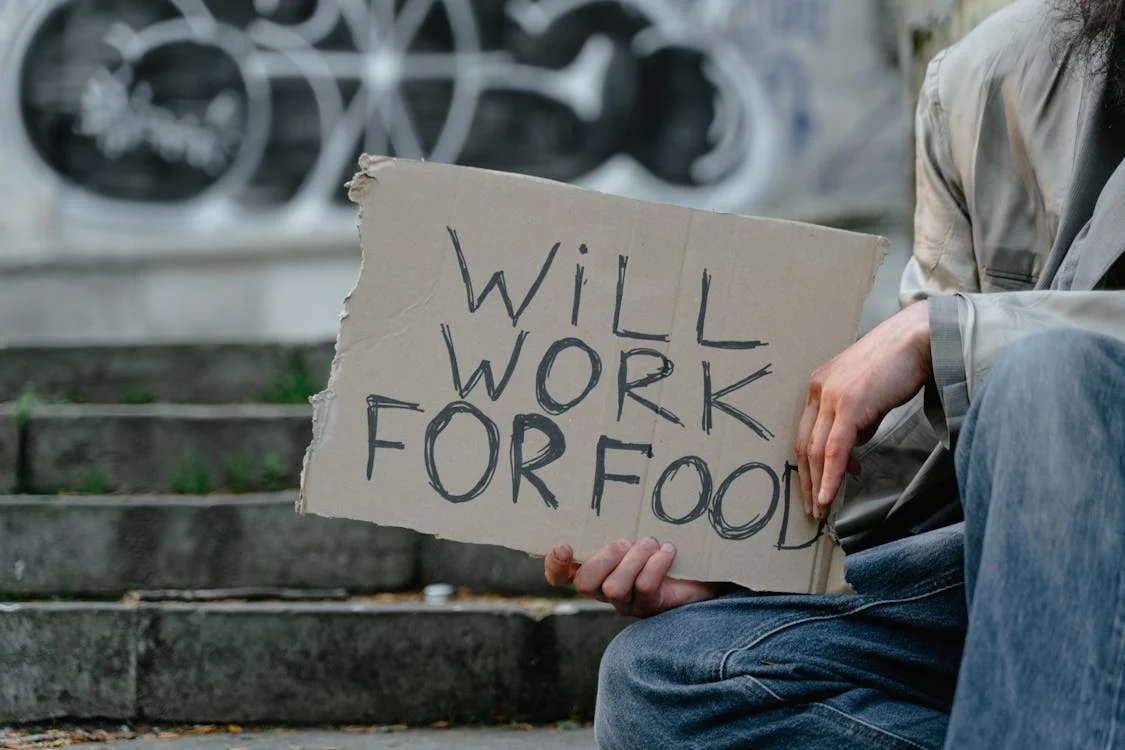

Sokoloski highlighted that the strike is only one of several factors contributing to the general downturn in production. “We know there’s a scale-back,” he remarked. “The streaming bubble has popped. Fewer episodes are being ordered of the shows that are in production, and a lot of shows have been canceled.” Additionally, there has been a noticeable shift in commercial production, with many projects relocating to other parts of the country or even overseas, reflecting broader industry trends and economic considerations.

This shift in the industry is also influenced by the changing landscape of media consumption. The rise of streaming services had initially led to an explosion of content production, but the market has become increasingly saturated. With streaming platforms reevaluating their strategies and cutting back on the number of new productions, the overall demand for production has softened.

Moreover, the industry is still adjusting to new norms post-pandemic, which include more stringent safety protocols and possibly increased costs of production. These factors collectively contribute to the slower recovery rate.

Looking ahead, the industry’s path to full recovery remains uncertain. Stakeholders are cautiously optimistic, hoping for a stabilization that will enable a return to pre-strike levels of activity. However, the industry must navigate the complex interplay of economic pressures, shifting consumer preferences, and the residual impacts of the strikes.

As Los Angeles strives to reclaim its prominence in the film and TV production landscape, the coming months will be crucial in determining whether the industry can adapt to these new challenges and return to its former glory.