Foot Locker’s newly announced pre-lease represents Los Angeles’s largest 2023 pre-lease. The agreement will see the athletic retailer develop 361,000 square feet of warehouse space in Los Angeles County. The land was acquired by Ares Management and the Black Creek Group for $46.1 million, which is being leased to them by Jones Lang LaSalle Incorporated (JLL). The El Monte Logistics Center will be a “Class A Cross Dock Logistics Facility” currently under construction. According to an announcement by Ares Management, it is expected to be ready by the end of 2024. Foot Locker’s lease of the facility should extend through the second quarter of 2031.

Foot Locker is one of the United States’ most prolific commercial retailers. Specializing in athletic clothing and footwear, it gained an international reach and opened over three thousand locations worldwide. Foot Locker’s website currently lists nine retail sites inside of Los Angeles. There is no statement whether this new warehouse acquisition represents the beginning of further regional investment.

Ares Management is a global investment manager in credit, private equity, and real estate. Black Creek Group is a US-specialized real estate management company previously based in Denver, which was acquired by LA-based Ares Management in 2021. Since then, many of Black Creek’s executives have been moved to Ares Management, and bot headquarters are expected to relocate to a new location inside Los Angeles before the end of 2024. The successful development and the lease of the El Monte Logistics Center represent a significant joint investment of the unified brands and a particular commitment to the Los Angeles area.

Jones Lang LaSalle Incorporated is a Chicago-based global real estate firm founded in the United Kingdom. It invests heavily in real estate, including office space, single-family homes, and extensive facilities like the El Monte Logistics Center. In May 2023, JLL reported a $9.2 million quarterly loss, including a 15% drop in revenue from the Market Advisory wing that handles property and real estate leases. At the time, JLL executives labeled this a temporary decline, and the agreement with Ares Management and Foot Locker could represent this. Pre-leases of this size are uncommon in the current market.

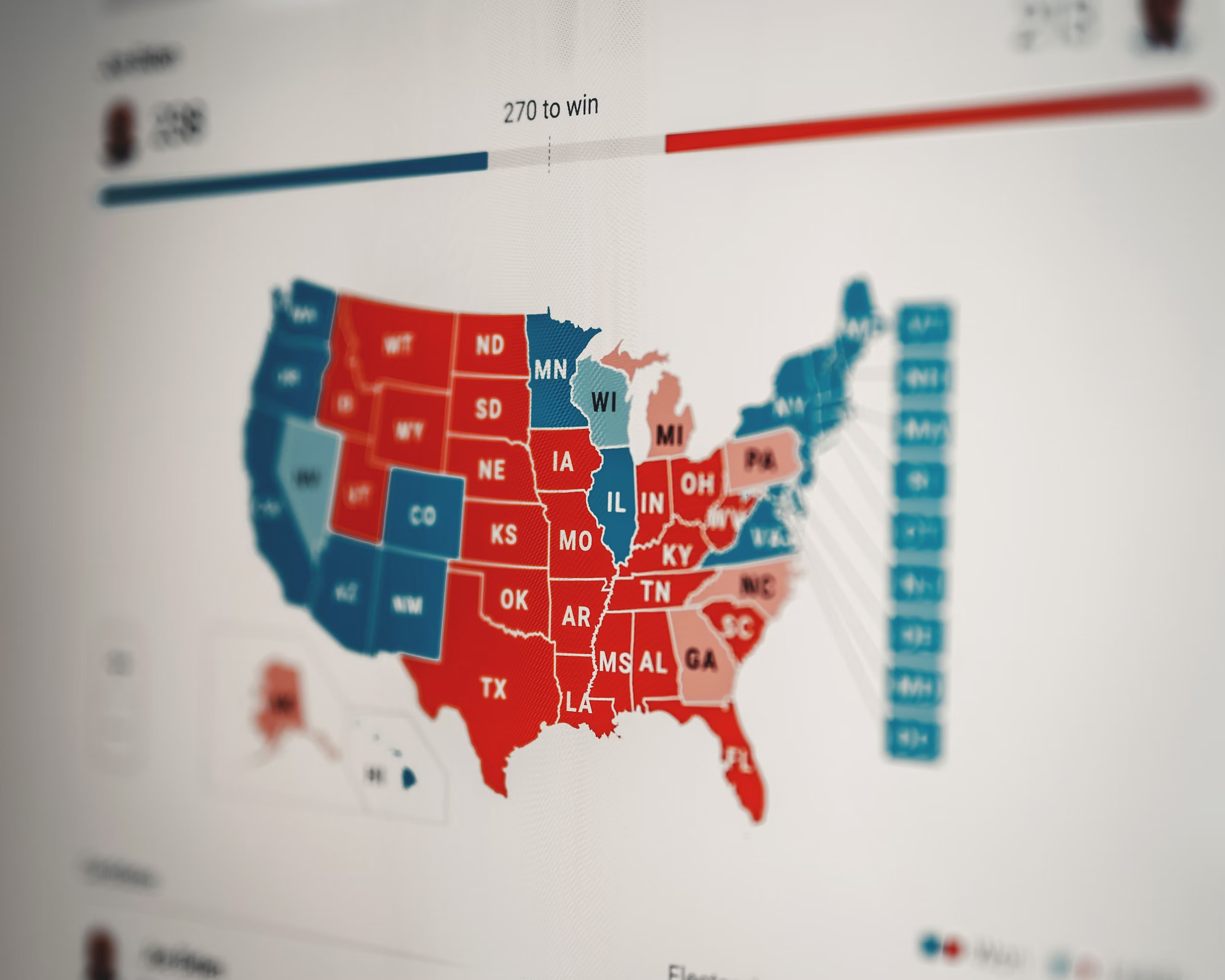

Such sizable acquisitions were more common during the high-stakes competition that defined the first years of the 2020s. The current industrial environment has largely trended toward occupiers lowering costs rather than securing competitive spaces. It is also true of other top markets, where trends show vacancies and sub-leases becoming more common over time.

Foot Locker’s move resembles strategies from a time of higher consumer spending. Other leases of similar size recently took place, including a renewal of 400,000 square feet by OnTrac in Commerce and a new lease of 443,000 square feet by National Road Logistics in Torrance. JLL’s executives had told investors in May that they expected investment activity to increase by the end of the year. This prediction has now been supported by Ares Management and Footlocker’s significant acquisition.