Image credit: Pexels

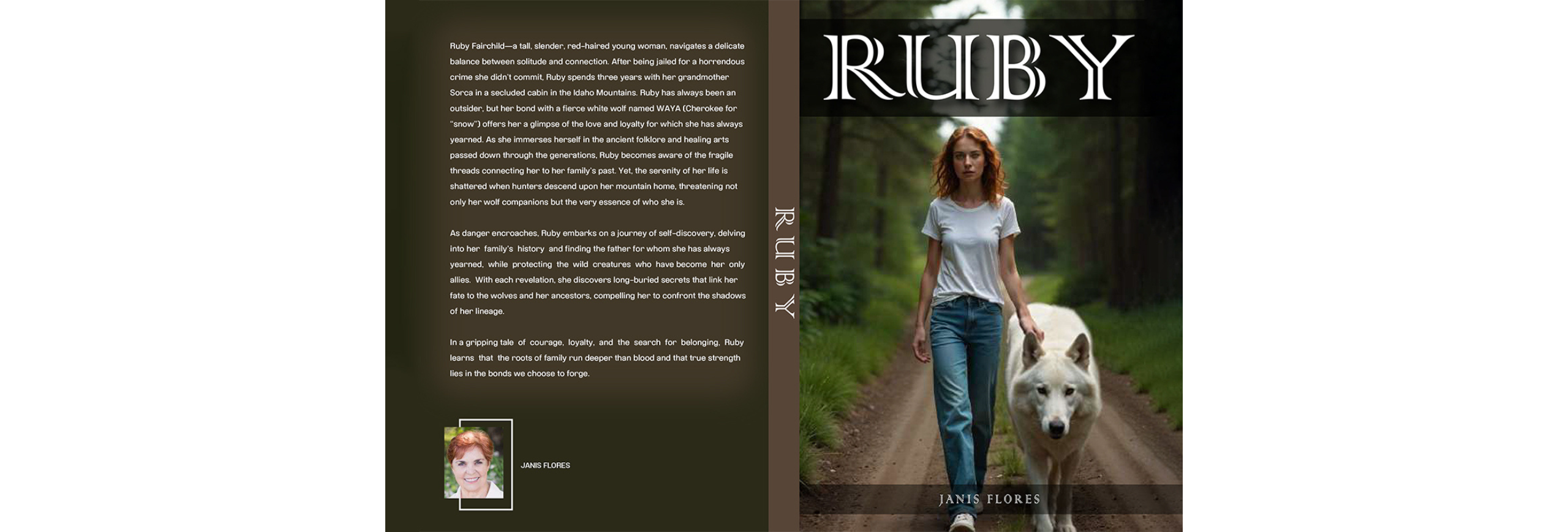

Blue Shield of California is currently navigating a significant data breach that may expose confidential information belonging to its vision benefits customers. In the aftermath of this breach, Blue Shield released a statement indicating that the sensitive information of individuals with Blue Shield of California vision benefits might be compromised. The incident occurred when hackers successfully breached a software program employed by one of Blue Shield’s vendors.

The compromised information encompasses a range of sensitive details, including customer names, dates of birth, addresses, Social Security numbers, and specifics related to treatment and diagnosis. Blue Shield, a prominent health insurer based in Oakland with approximately 4.8 million members, primarily in California, has yet to disclose the exact number of customers impacted or whether all affected customers have been notified.

The breach occurred on May 28 and May 31 when hackers gained unauthorized access to MOVEit, a file-transferring software tool used by a third-party provider managing Blue Shield’s vision benefits. While Blue Shield has refrained from disclosing the identity of this third-party vendor, it’s noteworthy that this incident was part of a more extensive global data security breach impacting numerous organizations relying on MOVEit.

The vendor responsible for managing Blue Shield’s vision benefits detected the breach in August. The vendor took immediate action by shutting down the server and initiating an internal investigation into the incident. They then promptly reported the matter to the FBI. Blue Shield was subsequently alerted in September, marking the initiation of their response to this security incident.

In response to the breach, Blue Shield has established a dedicated call center to address customer inquiries related to the incident. The call center operates from 8 a.m. to 7 p.m. Central Time, Monday through Friday, excluding major U.S. holidays. Additionally, in a proactive measure to assist affected individuals, Blue Shield has offered free credit monitoring coupled with identity restoration services.

Healthcare providers and Blue Shield recommend that individuals affected by the breach take specific precautions. These include a close review of credit reports and account statements, and prompt notification of any fraudulent activities or suspected identity theft to relevant authorities, such as law enforcement, the Federal Trade Commission, or the Attorney General’s Office in their home state.

Blue Shield recommends placing a fraud alert on credit files, with an initial free alert that remains active for at least 90 days. An extended alert, lasting seven years, may be placed on the credit files of those who have been victims of identity theft through the breach. Another precautionary step suggested by Blue Shield is considering a security freeze on credit files, preventing new credit from being opened without needing a personal identification number.

Recognizing the potential indicators of identity theft, Blue Shield emphasizes vigilance, urging affected individuals to remain attentive to any unexplained withdrawals from their bank accounts, missing bills or mail, refused checks by merchants, debt collection calls for unrecognized debts, unfamiliar accounts or charges on credit reports, and unexpected notices related to compromised information in data breaches.

As the investigation unfolds, Blue Shield of California and the FBI have been contacted for comment, highlighting the seriousness of the situation and the collaborative effort to address the breach and its implications for those affected.