Image credit: Unsplash

According to a recent report, long-standing small businesses in modern California may struggle to thrive the way they have in the past.

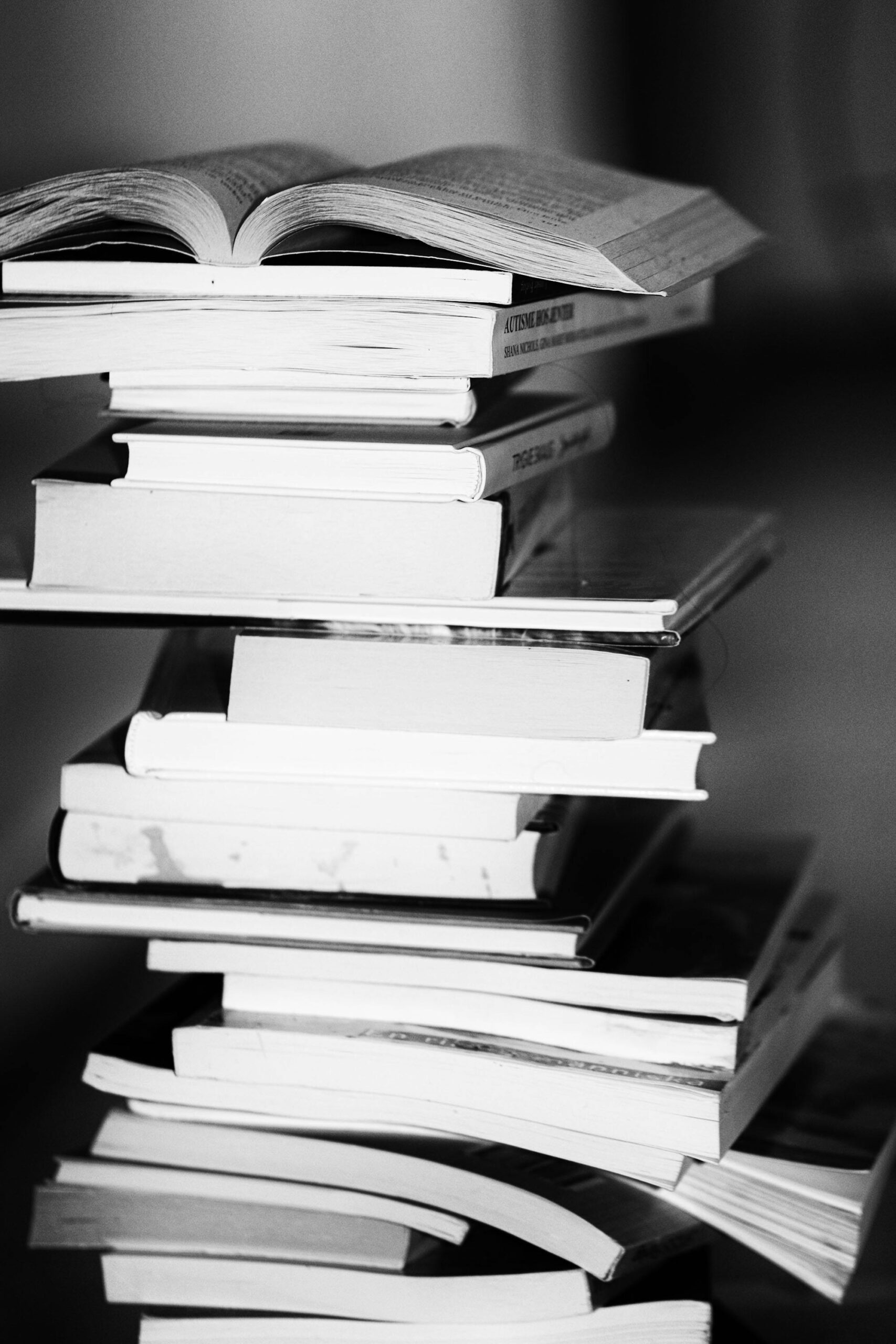

Whether a current resident, visitor, or small business, California has long been known for being one of the country’s most expensive states, and this became especially true following the COVID-19 pandemic. On Monday, the Los Angeles Times reported a story highlighting small business owner Karen Kropp and the struggles that have led her to close her bookstore, Book Rack.

L.A. Times reporter Marisa Gerber wrote, “After 40 years — the last half under Kropp’s ownership — the beloved used-book store tucked between a hot pot restaurant and a chiropractor’s office in Arcadia is closing this week.” She continued, “Slowed down by the consumer shift to online shopping and further decimated by cratering sales during the pandemic, the shop held on by a thread in the months since Kropp cashed out her life insurance policy to keep it afloat.”

Gerber also recalled when Kropp would say things such as, “When you’re in a bookstore, you have to be a dreamer,” and the “miracle is coming.”

The L.A. Times report spotlighted the damper on the owner’s sentiments, adding, “But the miracle never came, and Kropp, who turns 79 later this year, knew that even if she couldn’t really afford to, it was time to retire.” According to Gerber, “She [Kropp] plans to live off her monthly Social Security check — around $1,200 after insurance premiums are deducted — and can’t afford to stay in Southern California. Instead, she will move in with her younger sister in Albuquerque once she finishes clearing out the shop.”

“Kropp’s situation mirrors those of many aging small-business owners who, unless they have a relative eager to take over,” the report added, “are faced with complex questions about their legacy and finances.”

Utilizing a tool from the University of Massachusetts Boston, one estimate found that “Someone in Kropp’s situation — a single renter living in L.A. County — needs $2,915 a month to cover their basic necessities,” according to the report.

The director of the retirement security program at the UC Berkeley labor center, Nari Rhee, added that the estimated amount is “basically twice the average Social Security benefit in California.” Rhee continued to remark on how numerous elderly Californians have fallen victim to homelessness and poverty.

After years of working at the bookstore, Kropp purchased it in the 2000s, taking over a business that routinely brought in over $10,000. However, the meteoric rise of Amazon alongside the pandemic changed everything.

Gerber’s report stated, “Then, during the shutdowns, sales dropped to almost zero. Bills still came due, as did the shop’s rent and the fee for a storage unit where she kept overflow books, which together cost about $2,000 a month.” The report continues, “Sales eventually crept back up but never fully recovered; now, she said, it sometimes takes two days before sales hit $200.”

A recent sales analysis from GoBankingRates Found that even a $150,000 annual salary is considered “lower middle class” income in many of California’s high-cost cities.

California’s rent and state policies have been scrutinized by the L.A. Times before, such as when a 40-year-old attorney who moved to Florida from California, Krystal Meyer, was “driven out, she said, by financial pressures, homelessness, and a deep frustration with California’s COVID-19 restrictions.”

Meyer reportedly told the Times, “My salary increases were not outpacing my rental increases… I was losing money every year.” Although Meyer had already been driven out of one area of California following a confrontation with a machete-wielding homeless person, it was California’s response to the coronavirus pandemic that finally forced her to relocate to Florida.