Image credit: Unsplash

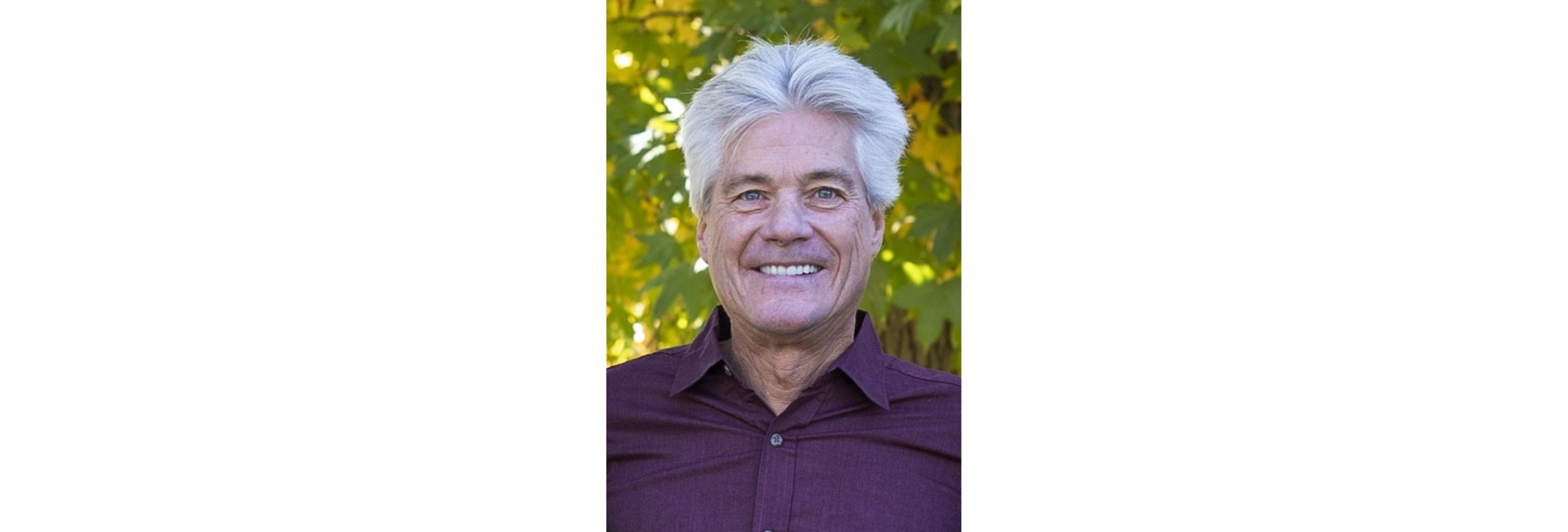

When Dennis Tomala made his first Bitcoin investment in 2014, it wasn’t because it was trending. It was because he believed it would change the future. At the time, he had already built a promising career in real estate. But what seemed like a pivot into the unknown soon turned into one of the boldest and most rewarding career moves of the decade.

Today, Tomala is not just another investor navigating the crypto space. He is the founder of HYGH Capital, a Web3 investment firm that blends traditional investment discipline with forward-thinking technology. His approach is helping modern investors rethink the future of finance.

Betting on Belief Before the Boom

Long before cryptocurrency became part of the mainstream, Tomala was already placing confident bets. Bitcoin was trading at $350, Ethereum was under $5, and Solana was still flying under the radar. For Tomala, it wasn’t about chasing hype. It was about conviction. That

$90,000 investment would later return over 9 million dollars.

But this was more than a win. It was a signal that the next chapter of investing would be different, and he was ready to lead it.

Launching HYGH Capital: A New Kind of Investment Firm

As crypto markets expanded, Tomala saw a clear gap. Traditional investors were missing out on transformative Web3 opportunities. That’s when HYGH Capital came to life. Focused on tokenization, real estate, and cryptocurrency, the firm identifies high-potential digital assets before they gain widespread attention.

HYGH Capital reflects Tomala’s sharp eye for early-stage deals and his disciplined approach to growth. What sets it apart is the mindset behind it, one guided by patience, clarity, and a belief that real impact takes time.

Grounded in Discipline, Guided by Faith

While crypto is often known for its volatility and hype, Tomala’s style is grounded and consistent. A lifelong martial arts practitioner, he brings the same focus and discipline to his business strategy.

At the core of it all is his faith. Tomala credits his belief in Jesus Christ as the anchor that keeps him balanced in a fast-moving world.

“In a space that moves fast and tests your values, faith keeps me grounded,” he says.

That foundation shapes everything: how he builds teams, how he invests, and how he leads.

Insider Access, Long-Term Vision

Over the years, Tomala has earned a reputation not just as a smart investor, but as a trusted figure in the space. His relationships with platforms like Binance and Bybit give him access to insights and deals few others can touch.

He has traded over 140 million dollars in cryptocurrency and invested in more than 80 blockchain companies, many at their earliest stages. His approach is simple: look where others aren’t looking yet, and move with purpose.

Looking Ahead: Altcoins, Asia, and What’s Next

Tomala believes the crypto industry is still just beginning. He sees major potential in emerging altcoins, decentralized platforms, and innovations coming out of Asian markets.

HYGH Capital is now actively expanding its footprint to meet that future. From private syndicates to founder partnerships, Tomala is building the next generation of investment vehicles without losing sight of what matters most: clarity, consistency, and character.

Final Word

Dennis Tomala didn’t just step into the future. He helped shape it. From real estate to digital assets, his story is one of discipline, foresight, and integrity.

As HYGH Capital continues to grow, so does Tomala’s impact, not just as an investor but as a leader whose values are as strong as his vision.

Written in partnership with Tom White