Image credit: Pexels.com

AI-driven voice systems are gradually changing how companies respond to customers across industries. Quick, accurate, and compliant communication is imperative in the insurance industry, and AI voice agents are emerging as a practical solution. These tools offer faster access to information, reduce pressure on human teams, and ensure that customers find reliable guidance beyond standard operating hours. Despite AI assistance, insurance companies continue to rely on human expertise for complex or emotionally sensitive communication, preserving the balance between efficiency and empathy.

AI Voice Agents in Insurance: A New Standard

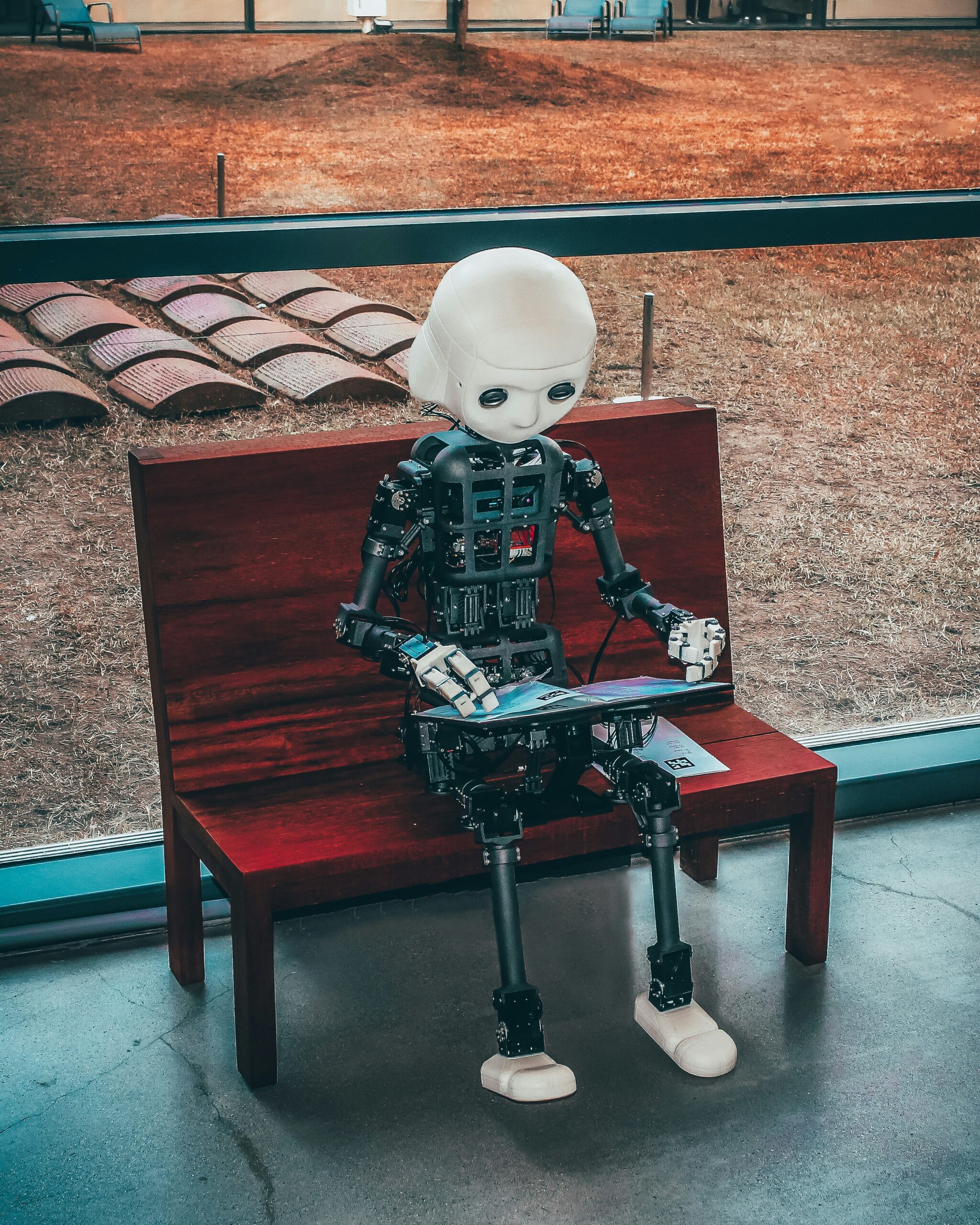

Insurance companies are now focusing on integrating AI voice agents into their core customer service operations. With these systems, insurers are offering round-the-clock customer support, enabling policyholders to check status updates at any time.

Customers can now request basic information or initiate claims without waiting for office hours. AI agents are also automating repetitive tasks such as verifying personal details or explaining standard coverage terms, freeing up human agents to focus on higher-value conversations.

A notable trend is the rise of hybrid service models. Instead of replacing human support teams, companies are dedicating AI voice agents to handle routine inquiries while directing complex questions to trained human specialists. This approach has not only improved response time but also created consistency in communication related to intricate policy language, reducing the risk of misinterpretation.

Case in Point

Eleos Life offers a glimpse into how forward-thinking insurers are in AI adoption. The company has developed an internal orchestration layer to ensure that all AI-generated outputs meet strict compliance and security requirements. It integrates large language models from OpenAI and Gemini with natural-sounding voice technology from 11 Labs, creating a system that can confidently and accurately manage customer conversations.

“My job as responsible for product development is mostly to use technology to make, at least, protection clearer, faster, and more human,” said Pedro Gonçalves, Head of Product at Eleos Life.

His statement reflects a broader industry understanding that AI simplifies processes without diluting the personal aspects customers value.

Impact and Consumer Reception

Early adoption of AI voice agents in the insurance industry has shown measurable improvements. Insurers report that routine requests, such as policy updates or documentation checks, can now be handled in minutes rather than days. This streamlining of routine tasks has resulted in higher customer satisfaction, especially among policyholders who value self-service options for simple tasks.

Another advantage of integrating AI voice agents is that the system allows human teams to devote more time to sensitive conversations involving claims disputes, bereavement, or financial hardship. These are interactions where empathy and nuance matter, and insurers acknowledge that technology alone cannot replace trained human professionals. However, consumers have shown increasing comfort with AI systems when the task is straightforward and predictable.

Final Thoughts

AI voice agents are not replacing human support teams; instead, they are empowering teams as efficient aides. As customer expectations rise for speed, accuracy, and accessibility, insurance companies are demonstrating that technology can meet these demands without compromising regulatory standards or compassionate service. The collaboration between automated efficiency and human judgment is setting a new benchmark for customer care in the insurance industry.