Building a Legal Organization, Not a Call Center

In Los Angeles’ competitive professional services market, growth often exposes structural weaknesses. American Tax Group, Inc. has pursued expansion differently, anchoring its model in attorney-led representation supported by disciplined operational infrastructure.

Founded by Justin Torbati, American Tax Group, Inc. provides full-service tax resolution for IRS and state matters nationwide. Services include Offer in Compromise submissions, installment agreements, penalty abatement, levy releases, appeals representation, and compliance restoration. Unlike many competitors that rely heavily on scripted intake departments, the firm was structured as a legal organization from inception.

Each engagement begins with a comprehensive legal and financial viability assessment. Attorneys review IRS transcripts, evaluate income and asset documentation, analyze compliance history, and assess enforcement exposure before determining whether representation is appropriate. Matters that lack statutory support are not pursued. This threshold discipline has become central to the firm’s reputation.

Attorney Accountability From Intake Through Resolution

At American Tax Group, Inc., attorney involvement does not end after case acceptance. Legal professionals remain responsible for strategy development, document preparation, and negotiation with IRS personnel. Transcript analysis, enforcement posture review, and procedural decisions are handled directly by attorneys rather than delegated to non-legal staff.

This continuity ensures that positions taken before the IRS are grounded in documentation and statute. Clients receive written legal explanations outlining enforcement risks, procedural timelines, and viable resolution options. Defined milestones and structured communication provide transparency throughout the engagement.

Such accountability stands in contrast to volume-driven models that separate sales from substantive work. By maintaining centralized legal oversight, the firm reduces procedural errors and improves consistency across cases.

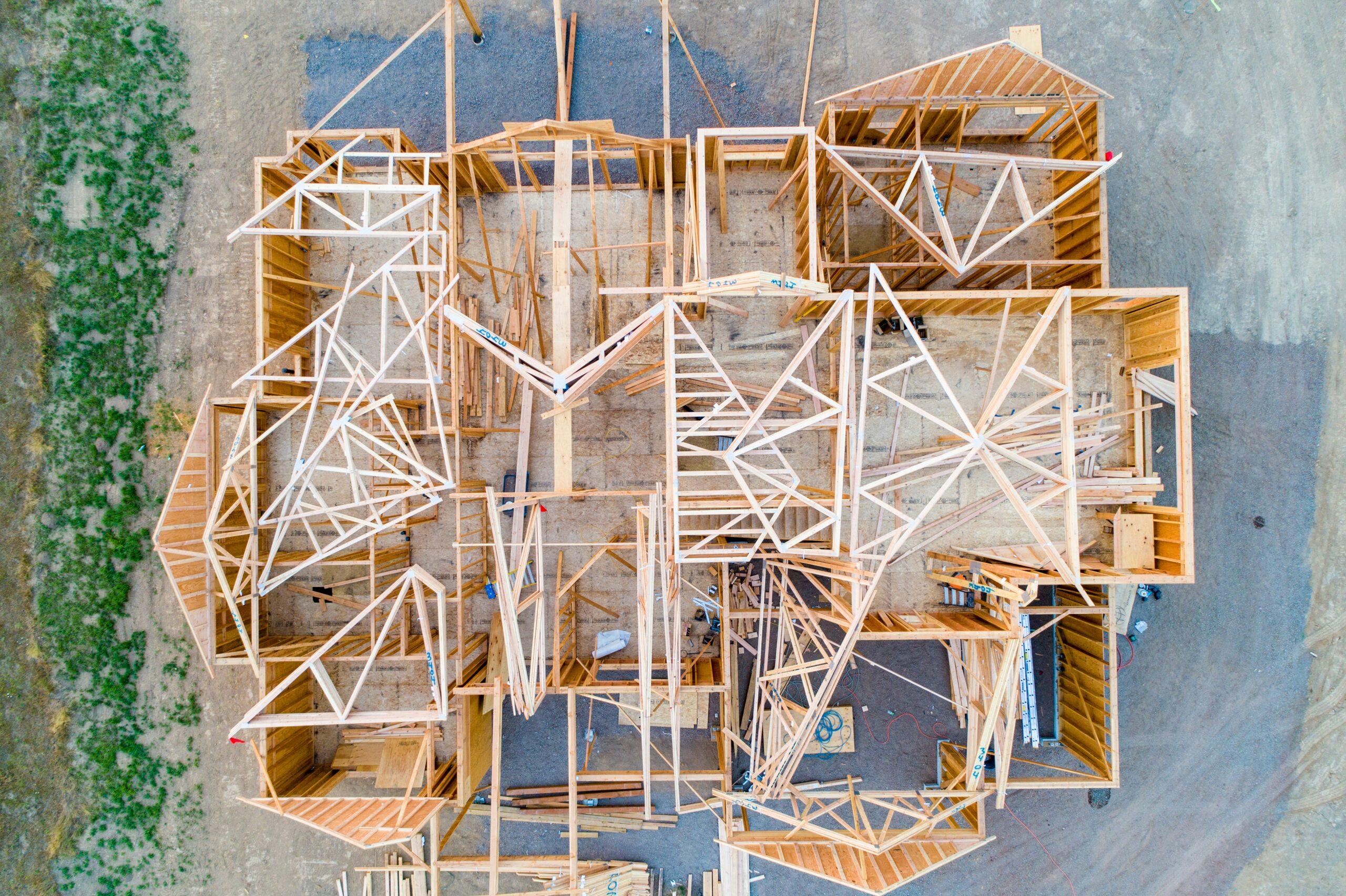

Infrastructure First, Scale Second

American Tax Group, Inc.’s recent strategic investment reinforces its infrastructure-first philosophy. Rather than allocating capital primarily toward advertising expansion, leadership has directed resources toward internal systems, compliance oversight, and professional training.

Enhancements to case management platforms provide real-time workflow visibility and reporting transparency. Structured quality control teams monitor filings and deadlines to ensure procedural adherence. Upgraded communication systems strengthen client engagement and data security protocols. These investments support national growth without diluting oversight.

Leadership has emphasized that sustainable scale requires operational discipline. Technology modernization and documented internal controls allow the firm to expand while maintaining consistency across jurisdictions.

A Structured Alternative in a Fragmented Industry

The tax relief industry has long faced criticism for opaque pricing, inconsistent representation, and exaggerated marketing claims. American Tax Group, Inc. has positioned itself as a structured alternative grounded in legal analysis and procedural rigor.

Fees are structured according to case complexity and the substantive work required. Resolutions are pursued only when supported by documentation and IRS guidelines. When alternative strategies are more appropriate than high-profile settlements, attorneys advise accordingly.

Under Torbati’s leadership, the firm continues to expand from its Southern California foundation into a national platform defined by accountability and compliance. In a market where rapid growth often precedes structure, American Tax Group, Inc. has demonstrated that attorney-led representation and scale can coexist when infrastructure remains the priority.

Written in partnership with Tom White