Image credit: Unsplash

In the realm of finance, change is not just inevitable; it’s the driving force that fuels evolution. One company making notable strides in this transformation is Gordeon, leveraging the potent combination of Open Banking APIs and biometric verification to redefine the future of financial transactions.

Open Banking APIs have emerged as a game-changer in the contemporary financial landscape. These advanced interfaces, operating as the conduit between varied software platforms, have allowed banks to share pivotal data through third-party applications. This may sound technical, but the practical implications are groundbreaking. It signifies that the once distinct lines between different financial service providers are blurring, enabling a holistic, interconnected ecosystem where data flows seamlessly, optimizing transaction experiences.

However, Gordeon’s utilization of Open Banking goes beyond mere integration. Recognizing the constraints smaller businesses face, especially startups without the financial muscle to construct intricate payment systems, Gordeon presents a pragmatic solution. By harnessing the power of APIs, these enterprises can now provide a broad spectrum of payment solutions – from digital wallets to traditional credit and debit options – without the hefty price tag traditionally associated with such technology. It’s a move that is not only commendable for its innovation but also for its inclusivity, bringing state-of-the-art payment options to a broader range of businesses.

Yet, for Gordeon, innovation isn’t just about facilitating transactions; it’s also about ensuring they are secure. This is where their expertise in biometric verification comes to the fore. In an era where digital security threats loom large, the promise of biometric identification — relying on unique physical or behavioral attributes like retina scans or fingerprints — offers a beacon of hope. Not only are these biological markers incredibly challenging to replicate, but they also present a user-friendly approach to authentication. No more remembering complicated passwords or PINs; with Gordeon’s tech, your identity is literally at your fingertips.

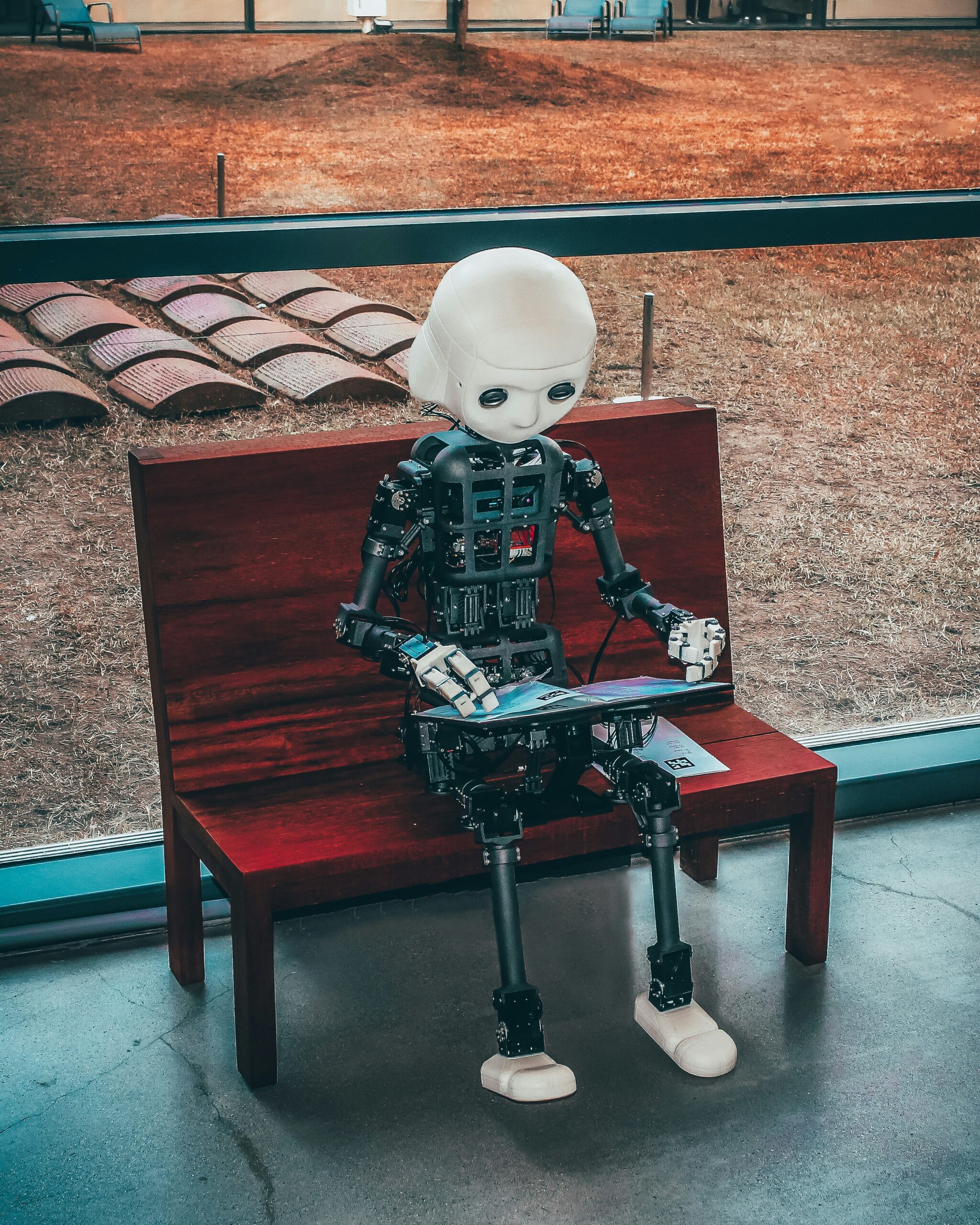

Moreover, in their quest for optimal user convenience, Gordeon is delving into the realm of AI-based voice assistants. Imagine executing a transaction or checking your balance with just a voice command. This isn’t science fiction but a reality Gordeon is actively shaping, integrating cutting-edge voice recognition systems into their payment platforms.

Gordeon stands at the intersection of innovation and utility. Their profound understanding of Open Banking APIs is democratically revolutionizing the payment ecosystem, bringing cutting-edge solutions to businesses irrespective of their size. Paired with their strides in biometric verification and AI voice technology, Gordeon isn’t just setting the gold standard for financial transactions; they are actively redefining it. As they continue to push the boundaries of what’s achievable, the broader industry watches, learns, and invariably, follows.

Written in partnership with Tom White.