Image credit: Unsplash

Los Angeles is not just about Hollywood glitz and glamour. The city is also a hotbed for startups seeking early-stage funding. For budding startups, an angel investor is a valuable resource because these investors do more than invest money; they offer guidance, connections, and perhaps some star power. Mentorship is also a useful resource for startups.

No matter which industry—tech, media, consumer goods—a startup is in, there is an angel investor who might be interested in investing in that entrepreneur’s vision.

Angel Investor for Early Stages Startups

Clark Landry is an entrepreneur turned investor and is a name often heard in the startup world. Because of his career trajectory, he has a unique edge when deciding where to invest. After founding his own startups, Clark has now made over 120 investments in various companies. He does tend to favor software businesses but is open to investing in all industries.

“Clark’s knack for spotting potential in early-stage companies is what makes him a standout in the angel investing scene. His journey from founder to investor is a testament to his deep understanding of what it takes to build a successful business,” says an industry insider.

Since his focus is on “seed-stage companies,” he is often one of the first investors in a startup. His mentorship based on his experience is invaluable, and he has a sincere interest in seeing startups succeed. Since he was an entrepreneur first, he also understands the difficulties startups face.

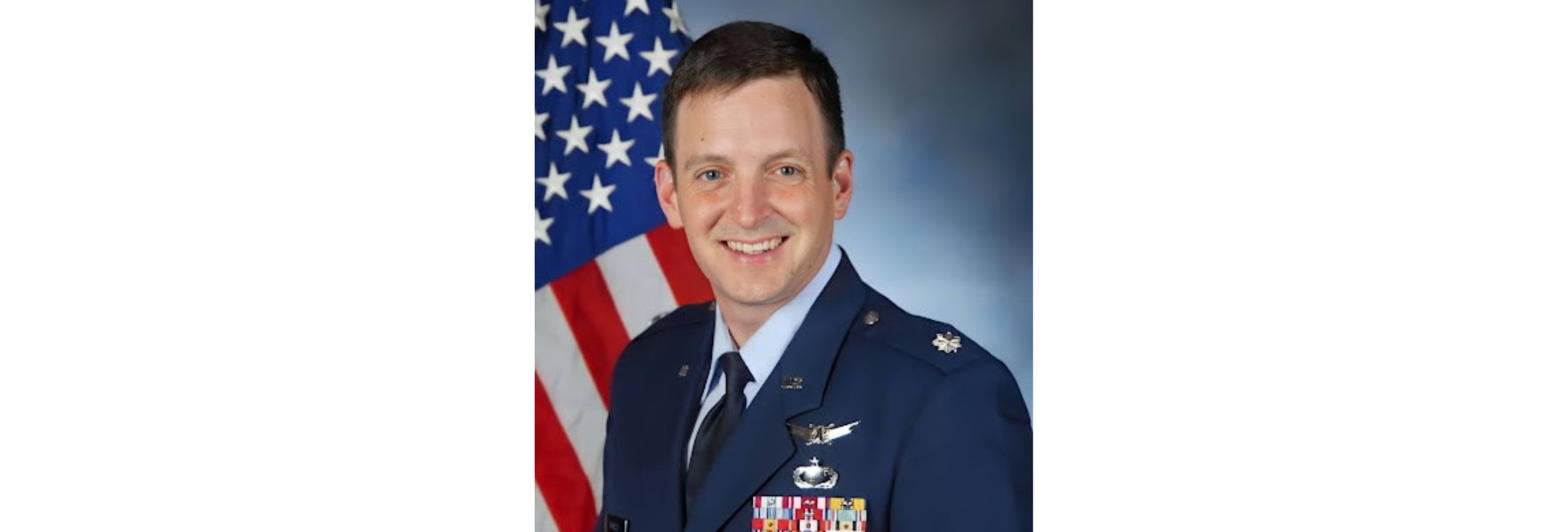

Angel Investor for Software and Life Sciences

In the startup scene of Southern California, Jim Brandt is a key angel investor. He is part of the Tech Coast Angels and focuses on software and life sciences. These two constantly evolving fields have plenty of investment opportunities.

The Tech Coast Angels have backed over 450 startups. The investment group is known for its active participation in the startup world. Brandt takes a strategic approach to investing and looks for innovation and potential growth in startups.

“I’ve always believed that backing the right idea at the right time can lead to transformative change. It’s about spotting that spark and helping it grow,” Brandt says.

Brandt is also an investor who is interested in mentoring entrepreneurs to reach their full potential.

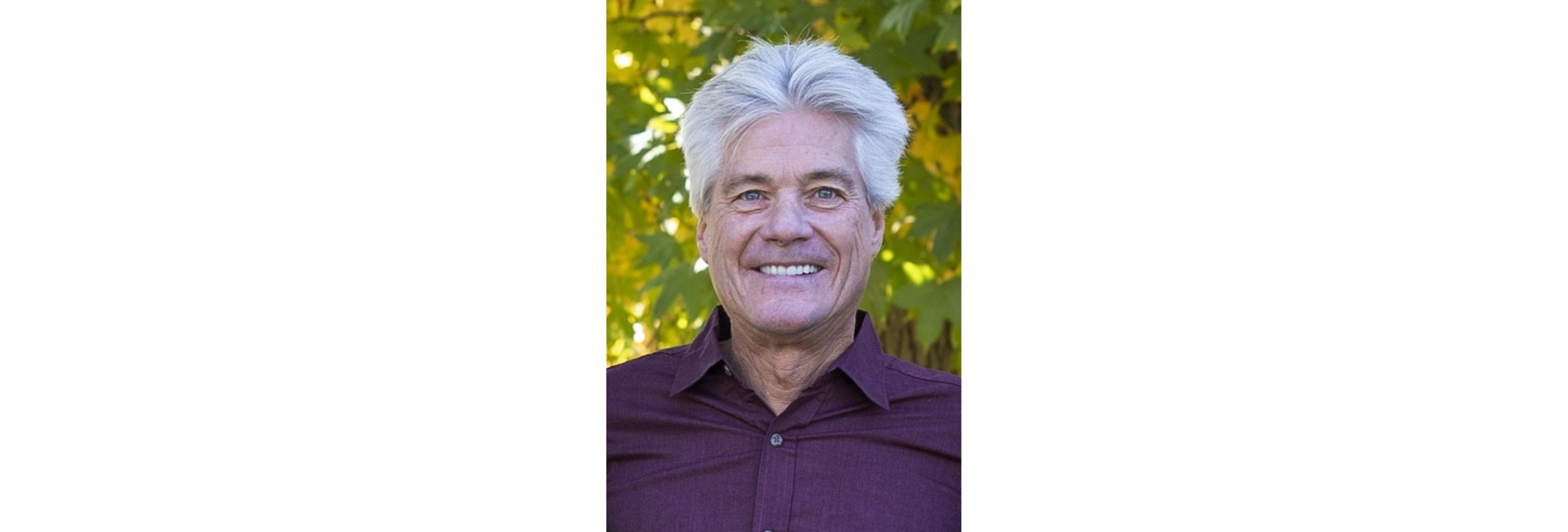

Angel Investor for Various Industries

Rosie O’Neill is considered a “powerhouse” in the investing world. She’s the founder of Sugarfina, a luxury candy boutique, and later started her investing fund, Pure Imagination Brands. O’Neill is open to exploring all opportunities in various industries. She is adept at spotting potential in early-stage startups and has backed over 50 startups. O’Neil prefers to be involved in startups when they’re just gaining their footing.

Mark Mullin is also open to investing in various industries and not focusing on just one. He had a successful career at RBC Capital Markets before he founded Bonfire Ventures. Mullin has a keen ability to spot potential early-stage companies. As he isn’t limited to one sector, he is open to all opportunities and is always on the lookout for the next big thing. He is known for his strategic thinking and takes calculated risks. Mullin doesn’t just care about making money but supporting ideas that can change the world.

Los Angeles Is Perfect for Entrepreneurs

Los Angeles is where tech, media, and culture mix, creating a fertile ground for startups. It’s where “creativity meets entrepreneurship” and offers entrepreneurs opportunities that can make all the difference in their endeavors. Angel investors can make a significant difference in startups, not only by providing financial backing but also by providing mentorships with influential investors.

By networking at local startup events to meet investors and always having a pitch prepared, entrepreneurs can take advantage of opportunities in Los Angeles that they might not find elsewhere.