Image credit: Unsplash

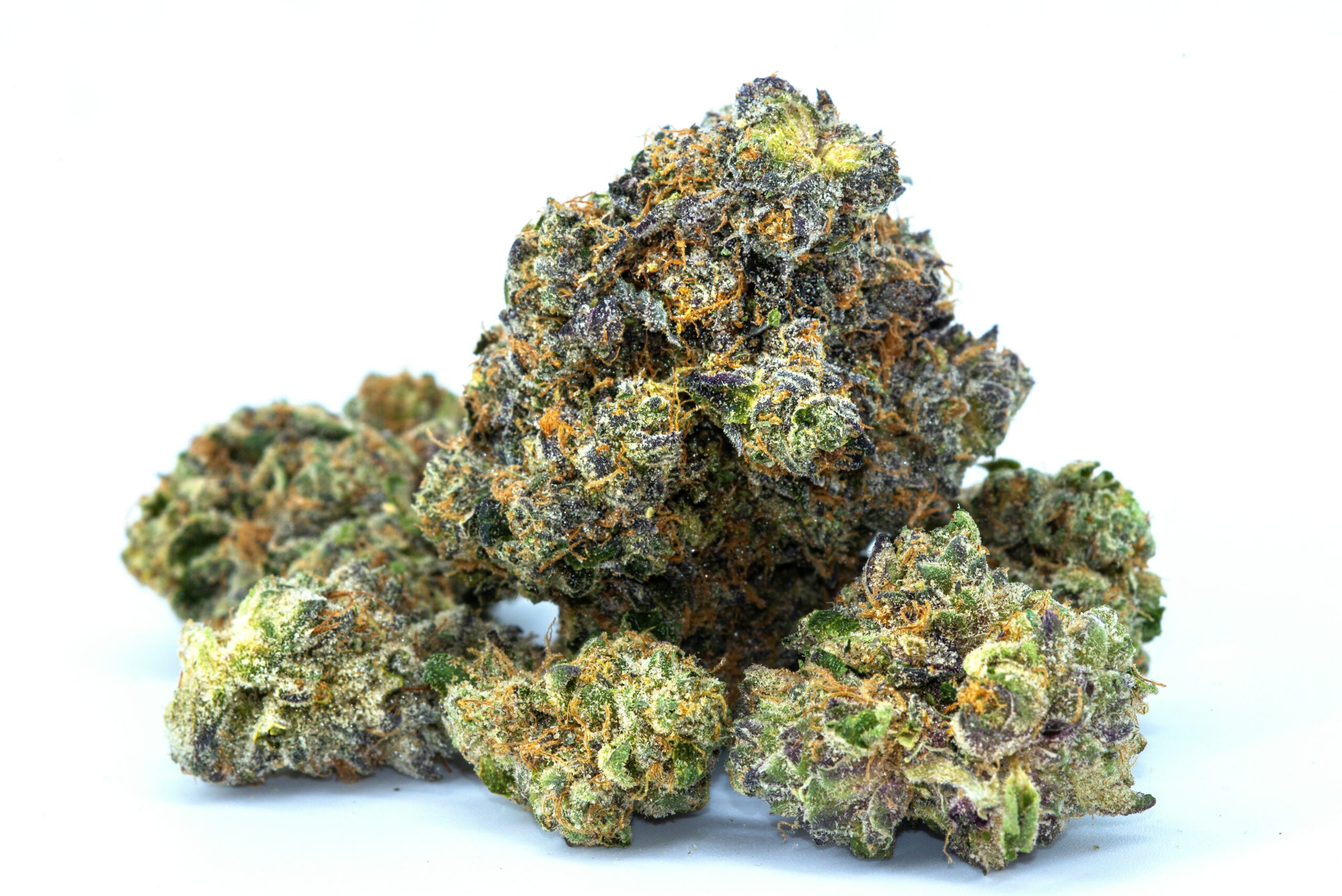

Los Angeles witnesses California’s novel strategy to tackle cannabis businesses’ unpaid taxes, presenting a peculiar chance for cannabis aficionados. The California Department of Tax and Fee Administration (CDTFA) recently confiscated assets from 10 cannabis establishments owing the state over $14 million in taxes. These assets found their way to a public auction on February 16, as part of efforts to recover a portion of the state’s missing funds, as announced in a CDTFA press release on February 8.

The auction, set against the backdrop of the California Highway Patrol’s parking lot in Los Angeles, featured an eclectic mix of items ranging from glass bongs, which are emblematic of cannabis culture, to snow cone machines and an assortment of office supplies. Despite the diverse selection of items on offer, the auction culminated in the state garnering a mere $2,075, as the North Bay Business Journal reported. This sum pales in comparison to the hefty $14 million in taxes owed, highlighting the state’s challenges in enforcing tax compliance among cannabis businesses.

Further scrutiny by the CDTFA revealed that a significant portion of these businesses were operating without the necessary licenses, a recurring theme in the agency’s ongoing battle against illicit cannabis operations in Southern California. This was not the department’s inaugural auction of seized properties linked to unauthorized cannabis activities. In March 2022, the CDTFA had previously auctioned a commercial property in Whittier utilized for an illegal cannabis operation. The auction was anticipated to recoup approximately $200,000, despite the operators owing the state $850,000 in unpaid taxes from that operation. The figure was mirrored in the sale of another confiscated property in Compton earlier that month.

The CDTFA’s vigilant efforts have resulted in more than 2,200 inspections conducted statewide, with the agency successfully seizing nearly $90 million in products and cash, per the data on the CDTFA’s website. The Director of the CDTFA, Nick Maduros, articulated the negative ramifications of unlicensed cannabis operations. He underscored that such entities undermine legitimate businesses by operating outside the legal framework established by California voters and deprive local communities of crucial revenue streams earmarked for essential programs. Maduros further lamented the proliferation of unregulated products stemming from these unauthorized businesses.

As of the time of publication, SFGATE has not yielded any response to attempts to solicit comments from CDTFA press representatives on the matter.

The sequence of events underscores the persistent challenges and complexities inherent in regulating the burgeoning cannabis industry in California. It sheds light on the state’s multifaceted strategy to enforce compliance and innovate in its attempts to recover lost revenues through unconventional means such as public auctions. This narrative serves as a professional, informative, and narrative storytelling piece, echoing the ongoing dialogue around the legalization, regulation, and taxation of cannabis within the state. It aims to provide readers with a comprehensive understanding of the current landscape and its implications for the state and its constituents.