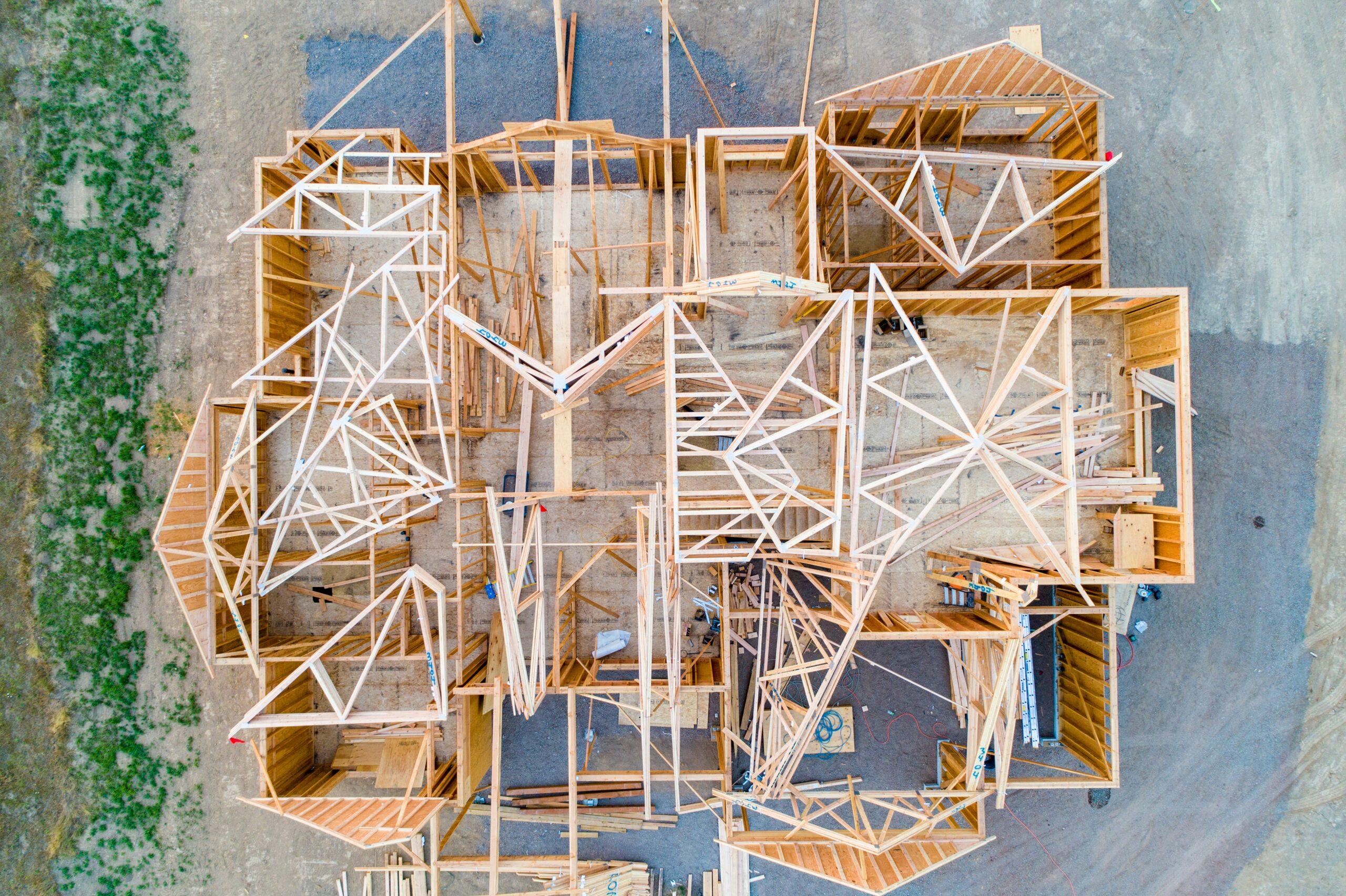

Image credit: Pixabay

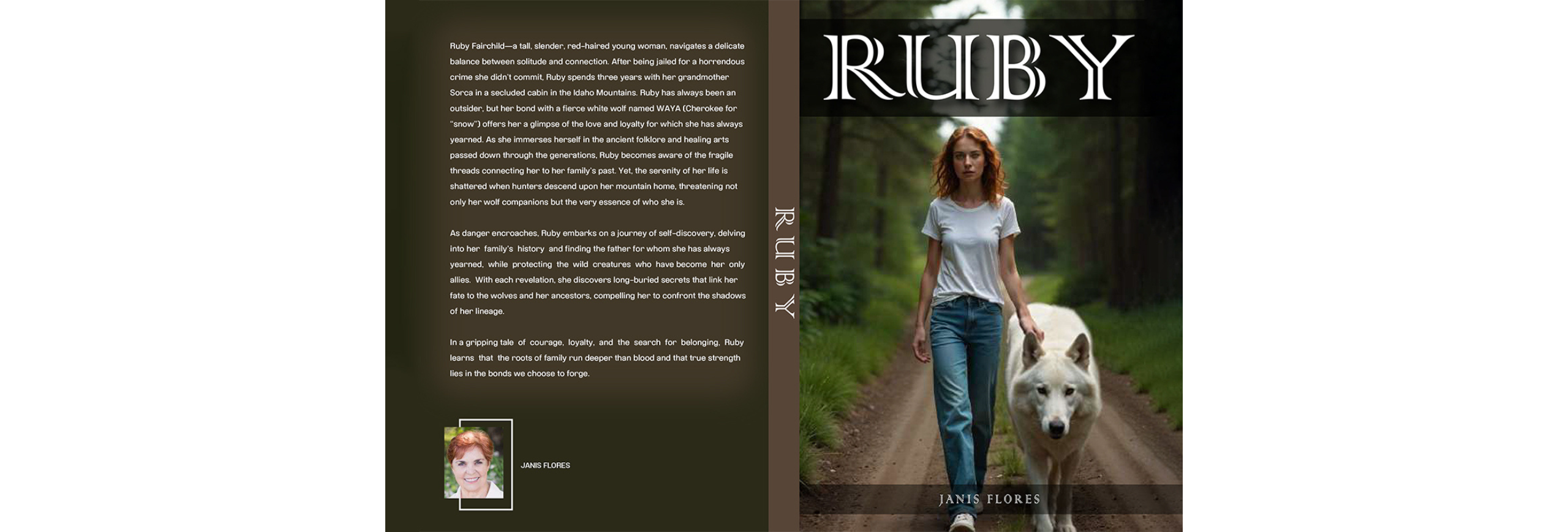

For many Americans, owning a home they are proud of is their life’s dream. However, multiple factors of today’s economic environment, including a high-cost market and high interest rates, have made this decision a challenging one, driving some prospective homeowners to rent until conditions improve.

Other variables, including lifestyle, sentimentality, and long-term goals, often influence these decisions as much, if not more, than potentially prohibitive real estate prices or mortgage rates. For these reasons, homeownership requires more planning and consideration than ever.

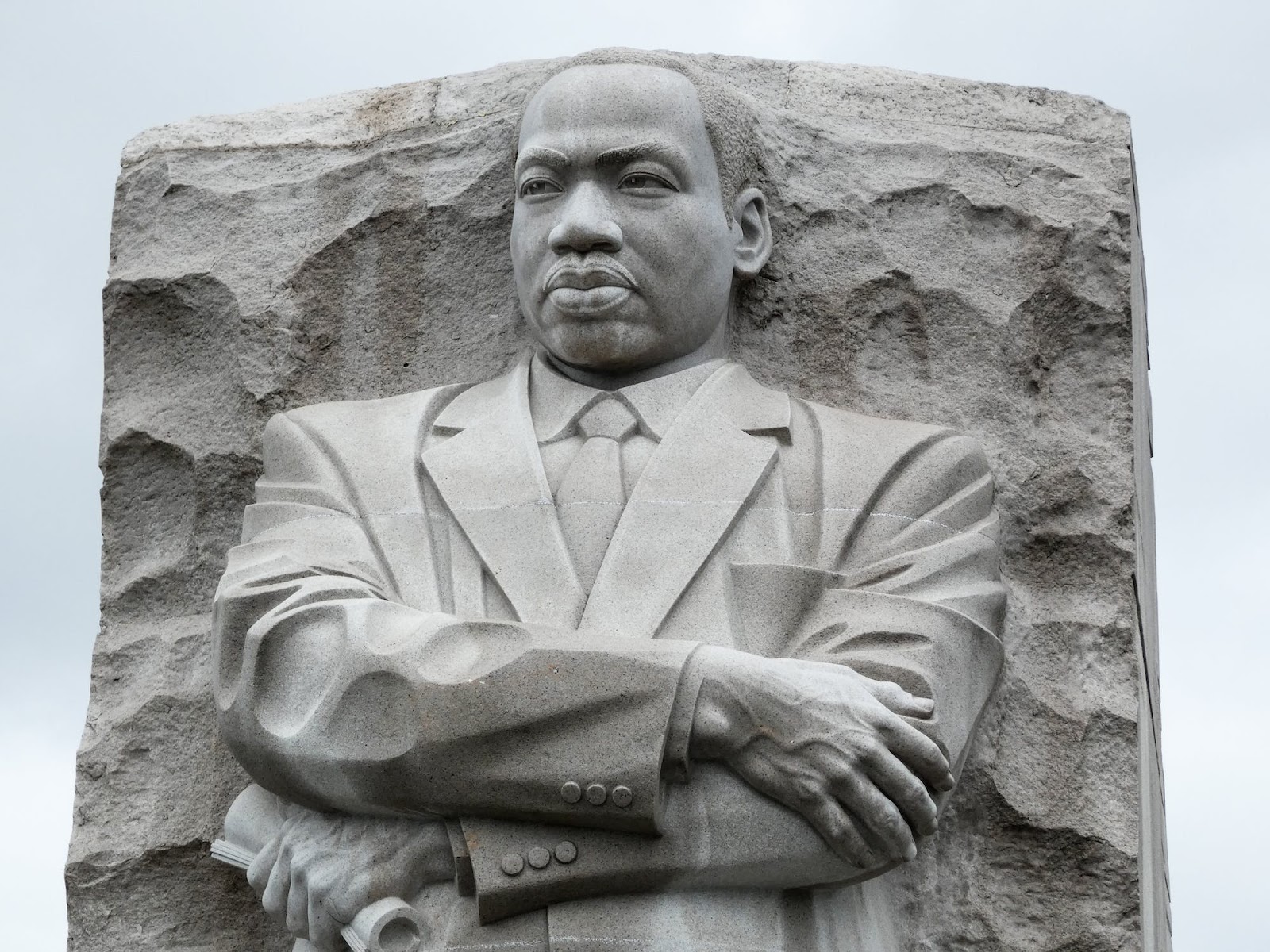

Homeownership and Sentimentality

Given its prominence in the American Dream, homeownership is tied to emotion as much as it is material reality. “Many people have an idea of a dream home,” says Michael Ashley Schulman, CFA of Running Point Capital. “It’s either the house they grew up in, or it’s the opposite of the house they grew up in.”

Either way, ideals like a spacious yard, a massive closet, or an in-ground pool can encounter challenges due to those material realities. Practical limitations compete with emotional priorities, sometimes resulting in compromise.

Modern Means of Financing a Home

Homebuying is not the same as it was 50 years ago. With the rise of dual-income households and improving government safety nets, some homeowners spend upward of 50% of their disposable income on housing, a far cry from the traditional rule of spending no more than one-third on housing.

These changes predominantly arise out of financial necessity. With heightened interest rates, there is a greater incentive to pay off the principal. Conversely, Schulman notes that, “when mortgage rates are lower… much more of your mortgage payment is going towards your principal.” It stands to reason, then, that buying a house when rates are more favorable means paying yourself and not just the bank.

The Upsides of Renting

Some view renting as a waste of time and money, but depending on the circumstances, renting can be a practical option, especially in the short term. For instance, frequent travelers or people concerned about location or job stability tend to value the flexibility that renting offers.

There are some financial advantages as well. While there is value in owning real estate, this value comes with hidden costs like insurance, property taxes, maintenance, and HOA fees. These costs can pile up quickly, potentially even exceeding the original budget for a given property. Renting can provide some respite during times of economic uncertainty, giving tenants time to gather themselves before moving on.

Considering Retirement and Second Homes

Long-term considerations have become more prominent in recent years, as buyers are increasingly interested in purchasing homes with retirement in mind. Factors like location, space, and proximity to healthcare have become increasingly important as a result. Planning so far ahead can prove challenging, but as Schulman notes, “We help them plan that out too… buying a home for your future self.”

There are a variety of strategies available to make these purchases financially viable, chief among them being tax deductions like donating land to conservation trusts. By employing these strategies and making the most of local advisory resources, the notion of a retirement spent in comfort and ease becomes all the more attainable.

Navigating Current Market Conditions

At present, the housing market is in a “heads you win, tails you don’t lose” state, benefiting those who can afford to buy sooner rather than later. Still, whether you’re renting, buying a home for the first time, or planning for retirement, all decisions should weigh sentiment alongside financial realities. Advisors can help provide perspective in this regard, ultimately helping homeowners feel confident they’ve made the right choice.